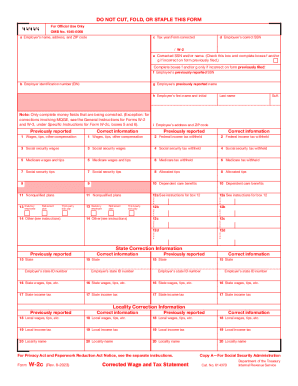

IRS W-2c 2024-2025 free printable template

Show details

Attention: You may file Forms W2 and W3 electronically on the SSAs Employer W2 Filing Instructions and Information web page, which is also accessible at www.socialsecurity.gov/employer. You can create

pdfFiller is not affiliated with IRS

Form W-2c 2025: instructions and help

How to edit W-2c form online with pdfFiller

How to fill out the W-2c form online in PDF format

Video instructions: completing your IRS W-2c form

Form W-2c 2025: instructions and help

Here you can find the requirements of W-2c form, along with step-by-step instructions for filling it out correctly.

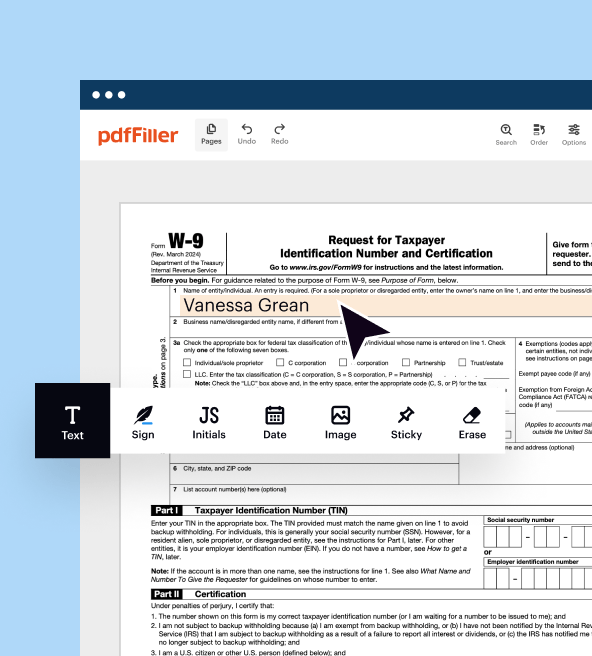

How to edit W-2c form online with pdfFiller

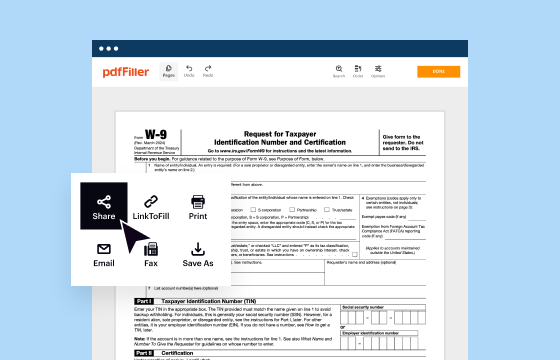

Editing tax forms with pdfFiller is a seamless process designed to save you time and ensure accuracy.

To edit your blank W-2c form online, simply:

01

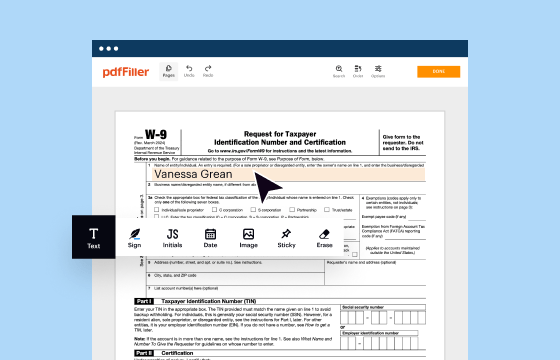

Click on Get Form at the top of the page to open the W-2c template in our editor.

02

Utilize our intuitive editing tools to complete the necessary fields by adding text, numbers, and checkmarks, guided by our helpful navigation tips.

03

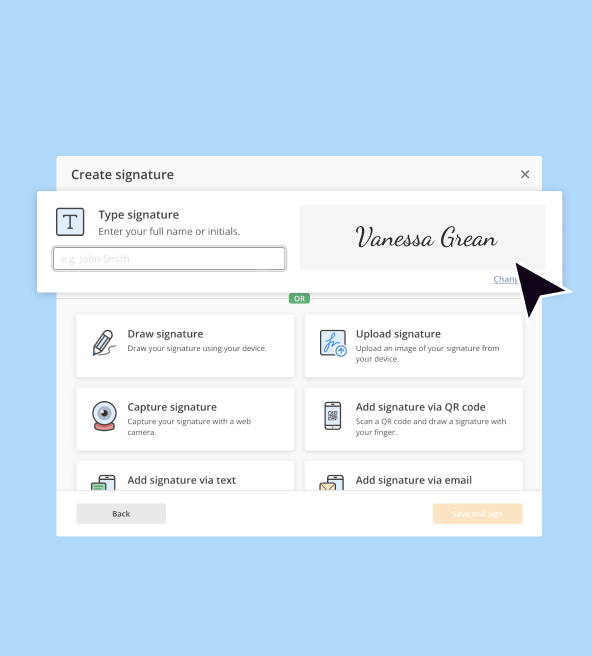

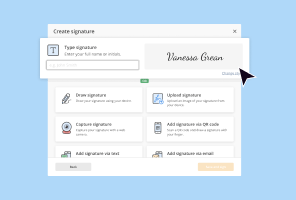

eSign your document using the Sign tool. Draw, text, or upload your signature.

04

Once finished, click Done to save your completed document.

05

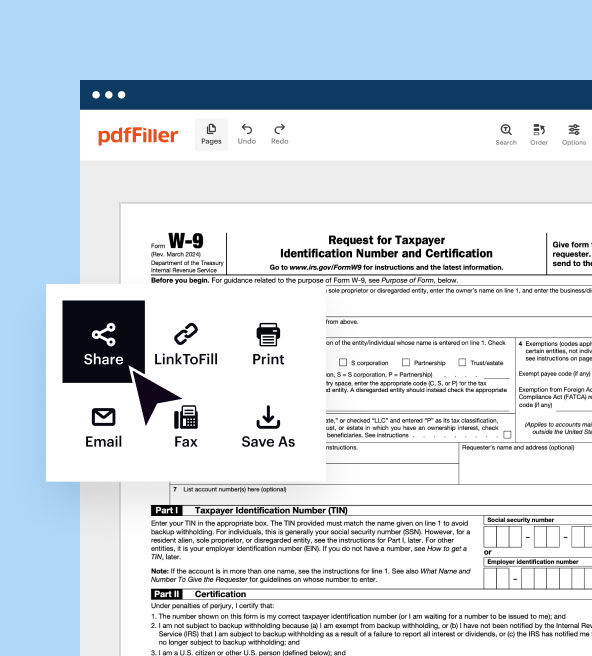

Create a pdfFiller account and enjoy a free 30-day trial to download, or print your filled W-2c form PDF.

06

Send your downloaded PDF document by email to the necessary recipient.

07

Print the form and send it by mail with Form W-3c, or use the Mail by USPS option for added convenience.

How to fill out the W-2c form online in PDF format

Filling W-2c form online is now easier than ever. You can choose from several platforms that help you complete your forms digitally, reducing errors and making the submission process a breeze.

Step 1: Obtain the IRS form W-2c fillable on the IRS website. Make sure you have the latest version for accuracy.

Step 2: Gather the necessary information: both the employer's and your personal one.

Step 3: Fill out basic information including the employer’s name and address, Employer identification number, and the year and type of the original form being corrected.

Step 4: Correct employee information for each employee, including their name, social security number, and corrected wages or tax amounts.

Step 5: Enter the previously reported and correct information in the boxes provided, following the prompts and instructions.

Step 6: Add or correct any codes from the original Form W-2 if necessary

Step 7: Review all entries for accuracy and completeness before submitting.

Step 8: Sign and date the form to certify the corrections if filing electronically, an electronic signature will be used.

Step 9: Download the printable copy of the filled Form W-2c for your records.

Step 10: Submit copy A using the SSA’s Business Services Online (BSO) if filing electronically. If submitting by mail, ensure you send it to the appropriate SSA address.

Step 11: Inform the employee about the corrections made and provide them with a copy of the corrected form.

Video instructions: completing your IRS W-2c form

Show more

Show less

Updates to completion of the W-2c form

Electronic Filing Requirements for Form W-2c

New box 12, code II for W-2c form

Changes to forms and publications related to W-2c form

Updates to completion of the W-2c form

Several changes have been made to the process of completing a W-2c form in 2024. You can see the list of the main ones and explanations for them here.

Electronic Filing Requirements for Form W-2c

Starting in 2024, if you originally filed a Form W-2 electronically using Forms W-2, W-2AS, W-2GU, or W-2VI, you must also e-file any corrections with W-2c form. However, if the original form was filed on paper because it was exempt from electronic filing, you can still file corrections on paper. This update helps keep everything consistent and ensures all your tax information stays accurate and easy to follow.

New box 12, code II for W-2c form

There's now a new code, "II," in Box 12 on Form W-2c for 2024. This is for Medicaid waiver payments, which are excluded from your gross income under Notice 2014-7. This helps those receiving Medicaid waiver program payments easily report these amounts correctly, and ensure they're not mistakenly included as taxable income. It’s all aimed at keeping tax reporting straightforward and precise.

Changes to forms and publications related to W-2c form

In 2024, information from older publications related to Form W-2c was combined into the updated Pub. 15 (Circular E). This consolidation means you’ll have a single, more convenient source for all your tax-related info, instead of searching through multiple documents. Plus, there's a new Spanish version available, making it easier for Spanish-speaking employers to stay informed and compliant with tax regulations across the U.S. and its territories.

Show more

Show less

General facts you should know about the W-2c form

What is W-2c form?

Who needs Form W-2c?

When are W-2c forms due to the IRS in 2025?

Is IRS Form W-2c accompanied by any other documents?

Where do I send W-2c form?

General facts you should know about the W-2c form

Whether correcting mistakes in an employee's Social Security Number, name, or amounts of wages and taxes withheld, timely submission of Form W-2c ensures accuracy in tax reporting and prevents discrepancies in employee wage records. It is a crucial document for maintaining integrity in tax filings with the Internal Revenue Service and the Social Security Administration.

Here’s some general information you may need about the form:

What is W-2c form?

Form W-2c is used as a W2 correcting form, to correct errors on a previously filed Form W-2. It allows employers to update mistakes related to an employee’s Social Security number, name, wages, or taxes withheld. This form is essential to ensure that both employers and employees have accurate records for tax purposes. Timely corrections help avoid potential issues with tax reporting and Social Security benefits.

Who needs Form W-2c?

Employers who discover errors on Forms W-2 they filed with the Social Security Administration must file the IRS form W-2c fillable. It's crucial for correcting information, such as incorrect wages or deducting errors in tax amounts. Employees do not fill out this form; it is the employer’s responsibility to ensure the accuracy of their employees' tax information.

When are W-2c forms due to the IRS in 2025?

There is no specific due date for Form W-2c, as it should be filed as soon as an error is discovered. Prompt filing helps ensure that corrections are reflected in IRS and SSA records as quickly as possible. This prevents any mishaps during tax filing season for both employers and employees, ensuring that tax returns and earnings records are accurate.

Is IRS Form W-2c accompanied by any other documents?

Yes, Form W-2c is often accompanied by Form W-3c when filing corrections with the Social Security Administration. Form W-3c acts as a transmittal form summarizing the corrected information from all the W-2c forms being submitted. When filing a W-2c, it's important to also review if any employment tax returns need correcting.

Where do I send W-2c form?

People frequently ask where to mail corrected W-2c. For paper submissions, send Form W-2c along with Form W-3c to the Social Security Administration’s Direct Operations Center in Wilkes-Barre, PA. For those utilizing electronic filing, the forms can be submitted through the Social Security Administration's Business Services Online. Filing electronically is encouraged and often required for larger businesses.

Show more

Show less

FAQ

What is Form W-2c used for?

Form W-2c is used to correct errors on a previously filed Form W-2. Common corrections include mistakes in the employee's name, Social Security Number, or wage and tax amounts. This form helps ensure that both employers and employees maintain accurate tax records. It's crucial to correct details to avoid discrepancies with the IRS and Social Security Administration.

When should I file a W-2c form?

You should file a Form W-2c as soon as you discover an error in the original Form W-2. Early correction prevents processing delays or complications in an employee’s tax return. There’s no specific deadline, but timely corrections can help avoid penalties or interest and ensure accurate payroll records.

How do I determine if I need to file Form W-2c electronically?

You must electronically file Form W-2c if you filed the original Form W-2 electronically. If the original Form W-2 was submitted on paper and was exempt from electronic filing, you may also file the correction on paper. The new rules for electronic filing are part of efforts to streamline the process for greater accuracy and efficiency.

What should I do if the employee's address was incorrect on Form W-2?

If the only error on the original Form W-2 was the employee's address, you do not need to file Form W-2c with the SSA. Instead, you can simply provide the employee with a corrected form showing the correct address. However, ensure the updated address appears accurately in your records for future documentation.

Can I correct more than one type of error on Form W-2c?

Yes, Form W-2c allows you to correct multiple types of errors in one submission. Whether you need to update a Social Security Number, name, or adjust wage and tax information, you can make these corrections simultaneously. Be sure to complete each relevant section accurately to reflect all necessary changes.

What happens if I make a mistake on the Form W-2c?

If you discover an error on a filed Form W-2c, you should issue another Form W-2c to correct it. Accurate information on tax forms is critical, so check entries thoroughly before submission. Contact the Social Security Administration if you need guidance, particularly if it involves complex corrections.

Fill out Form W-2c

Forms related to form W-2c

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.